Today, let’s delve into the world of low-interest-rate credit cards, a topic that often sparks curiosity and intrigue. When someone mentions “low-interest rate,” it’s crucial to understand that it can refer to two distinct things. In this article, we will explore both aspects, shedding light on introductory APR offers and low ongoing APRs.

Intro APR Offers: Navigating the 0% Terrain

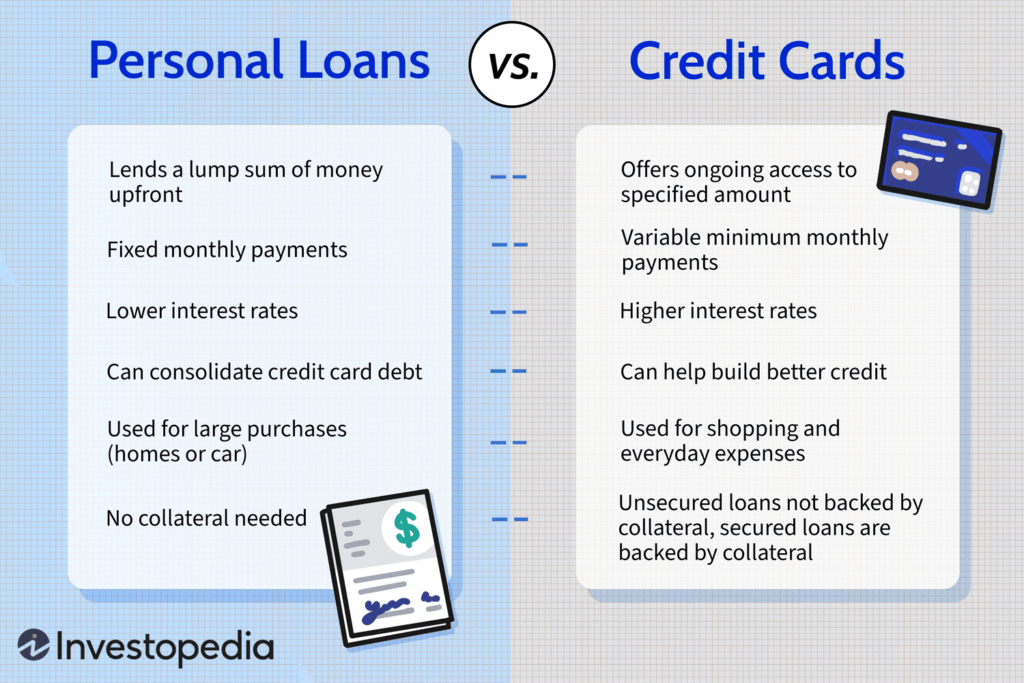

Credit cards with introductory APR offers provide a unique opportunity for financial flexibility. Whether it’s for new purchases or balance transfers, these cards grant a 0% APR for a predetermined period, typically ranging from 12 to 20 months. It’s like a financial breather, allowing you to manage larger purchases, and unexpected bills, or even tackle existing credit card debt without accruing interest.

Key Points to Consider:

- Intro Period Duration: Understand the length of the introductory period.

- Ongoing APR: Be aware of the standard APR after the introductory period.

- Balance Transfer Fee: If considering a balance transfer, note the associated fees (usually 3-5% of the transferred amount).

While the allure of 0% interest is undeniable, it’s essential to consider these factors when evaluating such credit cards. For a more detailed guide on zero percent APR credit cards, check out our website.

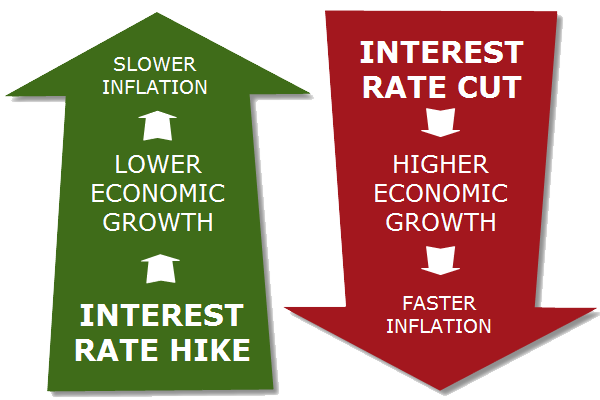

1. Understanding Low-Interest Rates

Low interest rates are the magic words in the credit card world. But what do they mean? Dive into the basics and unravel the mystery behind interest rates.

2. Benefits of Low-Interest Rate Credit Cards

Discover the myriad advantages that come with holding a card that offers lower interest rates. From saving money to financial flexibility, it’s a win-win.

3. How to Qualify for a Low-Interest Rate Card

Not everyone gets a ticket to the low-interest rate party. Uncover the secrets to boosting your eligibility and securing a credit card with favorable rates.

4. Comparing Low-Interest Rate Cards

Not all low-interest rate cards are created equal. Explore the market, compare the options, and find the one that suits your unique financial needs.

5. Tips for Responsible Credit Card Usage

Owning a low-interest-rate credit card comes with responsibilities. Learn the dos and don’ts to ensure you make the most out of your financial tool without falling into traps.

6. Common Misconceptions About Low-Interest Rate Cards

Separate fact from fiction. We debunk common myths surrounding low-interest rate credit cards, providing clarity in a world clouded by misinformation.

7. Navigating the Application Process

Embarking on the journey to secure a low-interest-rate credit card can be daunting. Fear not; we guide you through the application process step by step.

8. Case Studies: Real-life Savings Stories

Real people, real savings. Delve into inspiring stories of individuals who transformed their financial landscape with the help of low-interest-rate credit cards.

9. Maximizing Rewards on Low-Interest Rate Cards

It’s not just about low interest rates; it’s also about the perks. Learn how to squeeze the maximum benefits and rewards out of your low-interest-rate credit card.

10. Hidden Fees to Watch Out For

Beware of the lurking pitfalls. We unveil the hidden fees associated with some low-interest rate credit cards, ensuring you stay financially savvy.

11. Impact of Low-Interest Rates on Credit Score

Your credit score is the heartbeat of your financial health. Explore how low interest rates can influence and impact your credit score positively.

12. Future Trends in Low-Interest Credit Cards

What does the future hold for low-interest-rate credit cards? Peer into the crystal ball and get a glimpse of the upcoming trends in the credit card landscape.

Low Ongoing APR: A Steady Financial Companion

On the other end of the spectrum are credit cards with a consistently low ongoing APR, usually around 13%. This is a boon for those who want a reliable card with affordable interest rates for the long term.

Important Details:

- Average APR: The average interest rate for credit cards in the United States hovers around 16-17%, rising to 25% for those with poor credit.

- Variable Rates: Credit card APRs are often presented as a range, and your specific rate depends on your creditworthiness.

- Negotiation Possibility: While not guaranteed, you can try negotiating your APR with the credit card company, especially if you have a strong credit history.

It’s crucial to note that even if you qualify for a relatively low APR, carrying a balance month to month on your credit card can be an expensive way to borrow money.

Keep In Mind…

- Negotiating APR: Having a good credit history doesn’t guarantee the lowest APR, and rates are subject to change.

- Multiple APRs: Credit cards may have different APRs for purchases, balance transfers, cash advances, and penalties.

When applying for a low-interest rate credit card, while the appeal is undeniable, there’s no guarantee you’ll secure the lowest rate. It’s advisable to explore alternative borrowing sources for a potentially even lower interest rate.

In conclusion, understanding the intricacies of low-interest-rate credit cards empowers you to make informed financial decisions. While these cards offer significant advantages, it’s crucial to weigh the pros and cons based on your individual needs and financial habits. If you’re ready to embark on this financial journey, consider our guide your compass, navigating you through the complex landscape of credit cards.