Introduction to Credit card Debt consolidation

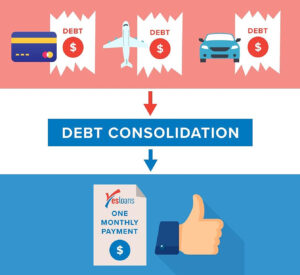

In the complex world of debt management, the terms “debt consolidation loan” and “debt consolidation program” are often used interchangeably, causing confusion among consumers. Unfortunately, some companies exploit this confusion through potentially misleading mailers and marketing tactics. In this blog post, we aim to shed light on the significant differences between these two options and provide a real-life example to help you make informed decisions. Additionally, we’ll share three crucial questions to ask when engaging with salespersons to ensure you understand which option is being pitched.

Title: Unveiling the Secret Sauce to Skyrocket Your Credit Score

Are you tired of traditional debt consolidation methods that don’t seem to move the needle on your credit score? It’s time to explore a game-changing approach that could transform your credit profile and elevate your financial standing. In this blog post, we’ll delve into a powerful strategy that involves leveraging business credit to not only consolidate your debts but also propel your personal credit score to new heights.

The Traditional Debt Consolidation Pitfall:

Many have experienced the disappointment of consolidating debts through personal loans, only to find that their credit score remains stagnant. Shifting balances from multiple credit cards into a single personal loan might provide convenience, but it often fails to boost your credit score significantly. The problem arises when individuals continue using their credit cards even after consolidation, effectively nullifying any positive impact on their credit score.

The Game-Changing Method: Business Credit Consolidation:

The key to unlocking a substantial credit score boost lies in a different approach – using your business credit. Here’s a step-by-step breakdown of the strategy:

- Establish Your Business Properly:

- Start by setting up a Limited Liability Company (LLC).

- Obtain a business license and open a business bank account.

- Secure an Employer Identification Number (EIN) for your business.

- Build Your Business Credit:

- Ensure that your business credit is in good standing. If you haven’t started building business credit, initiate the process immediately.

- Utilize Zero Percent Interest Business Credit:

- Acquire business credit cards with zero percent interest rates.

- Transfer your personal credit card balances to these business credit cards.

- Watch Your Credit Score Soar:

- Experience the magic of consolidating your debts at zero percent interest on your business credit.

- Enjoy the benefits of a lower debt-to-income ratio, as your personal credit no longer reflects those balances.

Why This Method Works:

- Business Credit at Zero Percent Interest: By consolidating your debts onto business credit cards with zero percent interest, you save significantly on interest payments.

- Rapid Credit Score Increase: Witness a remarkable increase in your personal credit score, with potential jumps into the 800s.

- Enhanced Financial Opportunities: Unlock doors to the best credit offers and products available in the market.

The Catch: Paying Attention to Terms:

While this strategy offers incredible benefits, it comes with a catch. Pay close attention to the terms, especially the duration of the zero percent interest rate. Ensure that you pay off the transferred balances before the introductory period ends to avoid high-interest rates later.

Real-Life Example:

Imagine receiving a letter in the mail stating that you’re pre-qualified for a $20,000 loan at a seemingly attractive 3.89% interest rate. Excited about potentially saving money by consolidating your high-interest credit card debts into a single loan, you contact the provided number or fill out an online form. However, you later discover that you didn’t qualify for a debt consolidation loan but are eligible for a debt consolidation program. This scenario is not uncommon, and it highlights the need to discern between the two options.

Understanding Debt Consolidation Program:

A debt consolidation program, also known as debt settlement or debt relief, involves falling behind on your accounts, potentially damaging your credit score, and facing the risk of legal action for unpaid debts. While debt consolidation programs can save you money and expedite your journey to debt freedom, it’s crucial to be aware of the potential downsides. To distinguish between the two options, ask the following questions when engaging with a salesperson.

Understanding Debt Consolidation Loan:

On the other hand, a debt consolidation loan entails receiving funds in your account to pay off high-interest credit card debts. Your accounts stay current, and your credit score could improve as you eliminate debt faster than by making minimum payments. While debt consolidation loans may have higher monthly payments compared to debt consolidation programs, they offer a more straightforward and transparent approach to debt management.

Three Crucial Questions:

- Source of Funds:

- Ask the salesperson if funds will be sent directly to your bank account or if you’re expected to stop paying creditors and deposit money into a special savings account. Debt consolidation programs do not provide funds like a debt consolidation loan.

- Interest Rate:

- Inquire about the interest rate associated with the debt consolidation. Debt consolidation programs typically do not have interest rates, as they are not loans. If the salesperson cannot provide a clear answer, it’s likely you’re dealing with a debt consolidation program.

- Type of Consolidation:

- Simply ask whether what’s being offered is a debt consolidation program or a debt consolidation loan. A transparent and honest response will help you understand the nature of the arrangement.

Conclusion: Mastering the Credit Game:

Consolidating debts through business credit is not just a financial maneuver; it’s a strategic game-changer. As you watch your credit score ascend, you’ll find yourself eligible for premium financial products and offers. This method, when executed properly, is a blueprint for achieving an extremely high credit score.

Understanding the differences between debt consolidation loans and debt consolidation programs is crucial for making informed financial decisions. By asking these three essential questions when engaging with salespersons, you can navigate the complexities of debt consolidation and choose the option that aligns with your financial goals. In the end, the goal is not only to reduce debt but also to do so in a way that positively impacts your credit score and financial well-being.

Are you ready to play the credit game at a whole new level? Start by building your business credit and strategically consolidating your debts – your credit score will thank you.